Key Takeaways

- HRD Corp compliance in 2026 goes beyond submitting claims and requires early planning, strong governance, and audit readiness.

- Employers lose levy value when scheme selection, documentation standards, and submission timelines are not aligned.

- HR leaders must shift from ad-hoc training activities to capability-driven workforce development strategies.

- Key workforce priorities for 2026 include AI literacy, digital transformation, ESG, leadership, automation readiness, and graduate development.

- Working with an HRD Corp–certified, audit-experienced provider helps reduce compliance risks and maximise levy return on investment.

Introduction

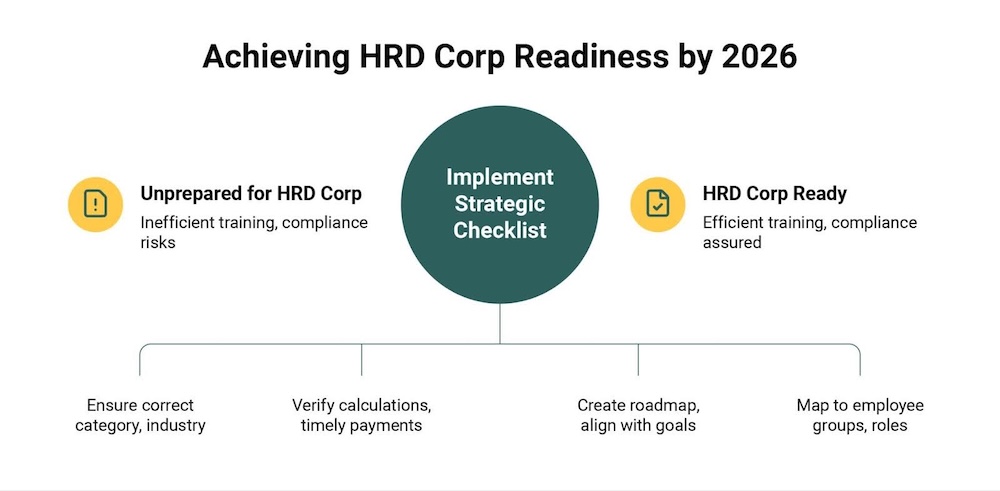

HRD Corp remains a key driver of workforce development in Malaysia, but 2026 marks a shift in how employers are expected to engage with the system. With stricter compliance expectations, a more structured Allowable Cost Matrix (ACM), and increased audit activity, HRD Corp can no longer be treated as a routine administrative or year-end exercise.

Employers are now required to take a more deliberate approach — ensuring levy accuracy, selecting the right schemes, aligning training with business priorities, and maintaining strong documentation discipline.

Organisations that plan early and use their levy strategically will gain stronger workforce capabilities. At the same time, those that rely on reactive or outdated practices risk rejected claims, audit issues, and lost levy value.

This HRD Corp 2026 Readiness Checklist helps HR leaders assess whether their organisation is prepared to use HRD Corp effectively and compliantly in the year ahead.

HRD Corp Strategic Readiness

Before planning any training initiatives, employers must ensure that their organisation is structurally and operationally prepared to use HRD Corp effectively in 2026.

Employer Registration & Levy Accuracy

- Ensure the organisation is registered under the correct HRD Corp category and industry classification, such as manufacturing, services, mining & quarrying, or other sectors listed under the First Schedule of the PSMB Act 2001, to avoid compliance exposure.

- Confirm whether registration is mandatory (10 or more Malaysian employees) or voluntary (5–9 Malaysian employees) based on workforce size and industry.

- Verify that levy calculations are accurate and aligned with HRD Corp payroll definitions, including what wage components are included or excluded.

- Maintain timely levy payments and conduct regular reconciliation to prevent discrepancies, penalties, or audit flags.

- Confirm there are no outstanding legal, payment, or compliance issues with HRD Corp that could affect eligibility for grants or schemes.

- Assign clear internal ownership for levy management, HRD Corp coordination, and compliance oversight (e.g., HR, finance, or L&D).

Workforce Planning & Training Alignment

- Create and document a 2026 training roadmap that outlines planned programmes across the year instead of relying on ad-hoc or last-minute training decisions.

- Align training plans with business goals, transformation initiatives, and identified workforce capability gaps (e.g., digitalisation, leadership bench strength, customer experience).

- Map training initiatives to specific employee groups, roles, or career stages, including early-career, managers, and high-potential talent.

- Incorporate structured graduate development pathways where relevant to support long-term talent pipelines.

- Ensure training investments are linked to measurable workforce or organisational outcomes, such as productivity, engagement, or readiness for change.

- Prioritise programmes that build sustainable, transferable capabilities rather than one-off or isolated interventions.

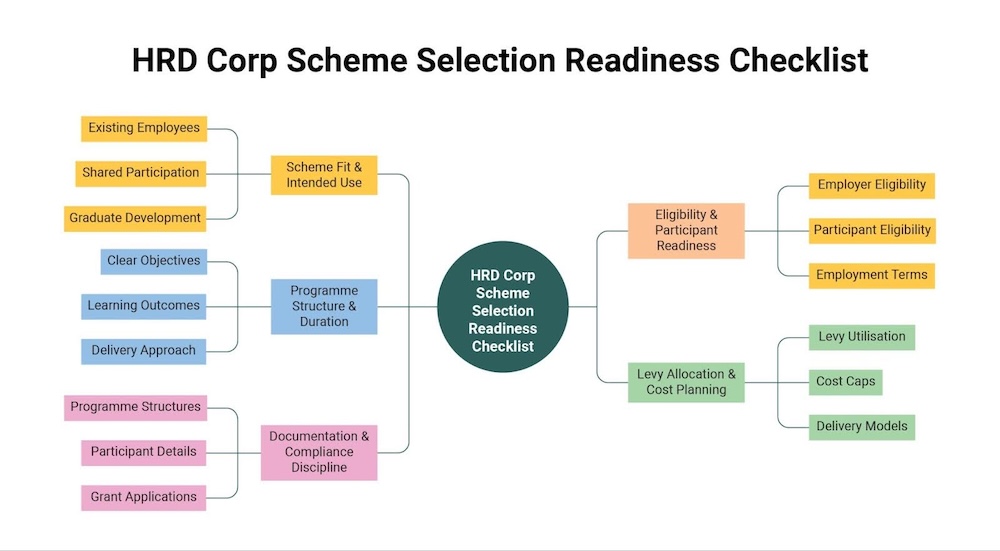

Scheme Selection Readiness Checklist (HCC, SBL, SLB, SGM)

Selecting the right HRD Corp scheme in 2026 is a strategic decision that affects compliance outcomes, funding eligibility, and how effectively levy funds are utilised. Employers should assess scheme suitability based on training objectives, participant profile, programme structure, and funding conditions, rather than defaulting to familiar schemes.

Scheme Fit & Intended Use

- Match each training or development programme to the most appropriate HRD Corp scheme based on its purpose and delivery structure.

- Consider whether the programme is designed for:

- Existing employees (e.g., leadership, digital, technical, or soft skills training).

- Shared or multi-employer participation.

- Early-career or graduate development through structured workplace exposure.

- Ensure the selected scheme aligns with how the programme is delivered (in-house, public, shared, internal trainer, external provider, workplace-based).

- Avoid using a single scheme for all programmes without assessing fit, as this increases compliance and rejection risk.

Eligibility & Participant Readiness

- Confirm the employer meets all eligibility requirements under HRD Corp, including having no outstanding legal, levy, or compliance issues.

- Ensure participants meet scheme-specific eligibility conditions, such as:

- Employment status and role for employee-based programmes.

- Graduate status, academic completion, and first-time employment conditions for graduate-focused programmes.

- Verify that employment terms, including full-time status and contract duration, align with scheme requirements where applicable.

- Validate eligibility early in the planning stage to prevent delays, rework, or audit findings later.

Programme Structure & Duration

- Design programmes with a clear structure that aligns with the expectations of the selected scheme.

- Define programme objectives, learning outcomes, duration, and delivery approach upfront.

- For longer-term development initiatives, ensure start and end dates are clearly documented and aligned with scheme conditions.

- Incorporate appropriate elements such as mentoring, on-the-job exposure, assessments, or structured learning activities, depending on programme intent.

- Ensure all programmes demonstrate clear capability development rather than informal or unstructured activities.

Levy Allocation & Cost Planning

- Plan levy utilisation across schemes to balance short-term training needs and long-term workforce development.

- Allocate levy funds in line with scheme-specific limits, including any percentage caps tied to levy balance as of 1 January of the application year.

- Monitor ACM cost caps and allowable cost items closely to avoid non-claimable expenses.

- Decide between internal and external delivery models based on cost efficiency, expertise required, and scalability.

- Use shared or pooled arrangements where appropriate to optimise budget efficiency.

Documentation & Compliance Discipline

- Prepare scheme-aligned documentation in advance, including programme structures, participant details, and trainer or mentor information.

- Ensure documentation clearly reflects learning objectives, duration, and expected outcomes.

- Submit grant or claim applications within the timelines specified for each scheme.

- Maintain proper records of payments, participation, and programme completion as required.

- Keep documentation organised and consistent to support audits and compliance reviews.

- Note scheme-specific requirements, such as whether post-programme claim submission is required or not.

Compliance & Audit Readiness Checklist

As HRD Corp strengthens audit enforcement in 2026, employers must ensure compliance measures are embedded from the start of every programme.

Documentation & Learning Evidence

- Define learning outcomes clearly and align them with HRD Corp expectations and ACM requirements.

- Use assessments, evaluations, or progress tracking to demonstrate skill and capability development.

- Standardise documentation across all training and graduate programmes, including agendas, materials, and trainer or mentor credentials.

- Maintain consistent record-keeping practices to support audits and compliance reviews.

Attendance, Records & Grant Discipline

- Monitor attendance or programme participation closely to meet scheme and ACM requirements.

- Organise and retain training and graduate development records systematically for audit purposes.

- Ensure submissions and documentation follow scheme-specific timelines and conditions.

- Implement internal compliance checks against ACM limits, attendance thresholds, and scheme rules.

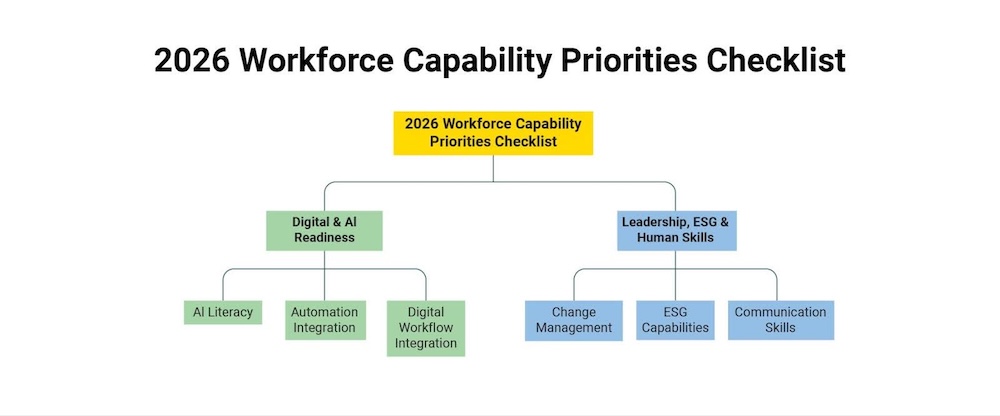

2026 Workforce Capability Priorities Checklist

HRD Corp should be leveraged not only for compliance but also to support long-term workforce transformation.

Digital & AI Readiness

- Build AI literacy and data fluency across relevant employee groups, not just technical teams.

- Prepare employees to work effectively alongside automation, AI tools, and digital systems.

- Focus training on practical workplace application and adoption rather than conceptual awareness alone.

- Integrate digital capabilities into daily workflows, decision-making, and performance expectations.

Leadership, ESG & Human Skills

- Develop leaders who can manage change, complexity, and digital transformation.

- Strengthen ESG and sustainability capabilities aligned with governance, reporting, and compliance needs.

- Enhance communication, collaboration, problem-solving, and people management skills.

- Support leaders and graduates in translating strategy into consistent execution on the ground.

Training Provider & Partner Readiness Checklist

The choice of training partner plays a critical role in ensuring compliance, programme quality, and long-term impact.

Provider Credibility & Compliance Experience

- Engage HRD Corp–registered providers with proven audit and compliance experience.

- Ensure trainers and facilitators meet HRD Corp accreditation requirements where applicable.

- Select programmes designed to meet ACM standards and deliver measurable learning outcomes.

- Work with providers familiar with HCC, SLB, and SGM documentation and governance expectations.

End-to-End Support & Strategic Value

- Work with providers that offer end-to-end support across programme design, documentation, and compliance readiness.

- Leverage advisory support for scheme selection, risk management, and levy optimisation.

- Focus on programmes that deliver measurable workforce and business impact, not just grant approval.

- Partner with providers that can scale and customise solutions across employee and graduate development needs.

Conclusion

HRD Corp in 2026 is no longer just about claiming training costs — it is about building a compliant, future-ready workforce through early planning, informed scheme selection, and disciplined execution.

Employers that assess their readiness, align training with business goals, and embed compliance into programme design will be better positioned to maximise levy utilisation and reduce audit risk.

Those who delay or rely on outdated approaches face a higher chance of rejected grants and unused levy. By adopting a structured readiness approach, organisations can turn HRD Corp into a strategic enabler of workforce transformation rather than a compliance burden.

If you want to ensure your organisation is HRD Corp–ready for 2026, connect with Thriving Talents to design a training and graduate development strategy that delivers both compliance and impact.