Key Takeaways:

- Many Malaysian companies lose part of their levy due to poor planning and under-utilisation.

- Team building is HRD Corp-claimable when tied to measurable learning outcomes like leadership, collaboration, and EQ.

- Plan early with an annual HRD Corp training calendar mixing soft skills, leadership, and team building sessions.

- Strategic team building improves engagement, retention, and communication, offering measurable business ROI.

- Treat the levy as a yearly training investment, not a tax—avoid losing funds to missed deadlines.

Introduction

Every Malaysian company that contributes to the Human Resources Development Corporation (HRD Corp) levy holds an opportunity, yet many don’t fully use it.

The HRD Corp levy isn’t just a regulatory requirement; it’s a training investment fund that can fuel workforce growth, engagement, and innovation.

However, year after year, thousands of employers lose unutilised funds simply because they don’t plan ahead or don’t realise which programmes (including team building) are actually claimable.

In this article, we’ll show HR and business leaders how to maximise your HRD Corp levy through strategic, skill-based team-building programmes, ensuring every ringgit goes back into developing your people and culture rather than being forfeited.

What is HRD Corp Levy?

The HRD Corp levy is a mandatory monthly contribution imposed on employers under the Pembangunan Sumber Manusia Berhad Act 2001 (PSMB Act 2001), set at 1% of monthly wages for employers with ten or more Malaysian employees.

For employers with five to nine Malaysian employees, registration is optional, and the levy rate is 0.5%.

The purpose of the levy is to fund training and development programmes through HRD Corp, allowing employers to upskill their workforce, claim training grants and enhance organisational productivity.

Contributions that remain unused for extended periods (or when other conditions are not met) may be forfeited or subject to deductions, underscoring the importance of strategic levy utilisation.

Program Latihan MADANI (PLM) is an initiative under Budget 2025 to empower micro-SMEs and vulnerable communities through training funded by unused HRD Corp levy balances.

Also read: MADANI Graduate Scheme (SGM) – What We Know So Far

According to 2024 update:

- Employers with a levy balance of RM 50,000 and above and utilisation below 50% for 2024 faced a 15% deduction from their remaining levy.

- The grace period started from 1 January to 28 February 2025, after which the deduction takes effect on 1 March 2025.

(Sources: HRD Corp Circular No 5/2024 )

How is HRD Corp Levy calculated?

Here’s what you need to know about how the HRD Corp levy is computed — clear, straightforward, and essential for compliance.

Applicable Rate

- For employers with 10 or more Malaysian employees, the levy rate is 1% of monthly wages.

- For employers with 5 to 9 Malaysian employees who register voluntarily, the rate is 0.5% of monthly wages.

Wage Base for Calculation

- The levy is calculated as:

Levy = (Basic Salary + Fixed Allowances) × Applicable Rate. - Fixed allowances include housing allowance, cost-of-living allowance, long-service allowance, leave pay, etc.

- Excluded payments from the base calculation include bonuses, commissions, overtime, shift allowances, travel allowances, and other variable pay.

(Source: HRD Corp support page)

Key Compliance Details

- The levy must be paid by the 15th of the month following the salary month to avoid arrears.

- To avoid arrears, late payment penalties of 10% may be imposed.

- Once an employer reaches 10 Malaysian employees for the year, the 1% rate continues for the remainder of that year — even if headcount later drops.

Why Should HR Departments Utilise the Levy?

Failing to properly utilise your HRD Corp levy isn’t just a missed opportunity—it can hit your budget, workforce morale, and organisational performance.

- Unused levy funds may be forfeited if training claims aren’t made within the stipulated timeframe, compelling employers to lose funds one way or another.

- When teams aren’t trained, you face hidden costs: disengaged staff, higher turnover, slower project delivery, and weaker cross-team collaboration—each of which drains resources more than training would have

- Under-utilised levy shows up in HR and finance KPIs—think low training hours per employee, poor retention, and reduced productivity—undermining both talent strategy and cost-controls.

- The levy should be seen as an investment in capability, not just an expense. When funds go unused, it means you’ve effectively paid for nothing while your workforce misses out.

By treating your levy as a strategic annual training budget—rather than a “use-it-or-lose-it” tax, your organisation can turn potential waste into real value.

Also read: How Can HR Leaders Adapt the MADANI Scheme to Strengthen Graduate Integration

Why HR Teams Keep Losing Their HRD Corp Levy Each Year?

Many HR and training teams simply don’t make full use of the Human Resources Development Corporation (HRD Corp) levy, even though it’s designed to fund employee development.

In fact, despite record-level collections (RM 2.3 billion in 2024) for HRD Corp, many employers still fall short of utilisation targets. (Source: The Star)

Common reasons for lost levy funds: unclear training roadmap, time constraints for applying, and confusion about what programmes qualify for claims.

The mindset needs shifting: the levy isn’t a “tax to pay” but a yearly investment budget for strategic training and development.

Is Team Building HRD Corp-Claimable?

Yes, corporate team building programmes can qualify under the Human Resources Development Corporation (HRD Corp), provided the training meets key conditions and clearly delivers learning outcomes.

So what makes a team building programme claimable?

- It focuses on communication, collaboration, leadership, emotional intelligence (EQ) and problem-solving, not just games for fun.

- Training is conducted by a registered provider and is properly documented with trainer profiles, session outlines and measurable outcomes.

The Latihan MADANI initiative (Program Latihan MADANI) reflects HRD Corp’s push for structured, purpose-driven training across industries and communities. Team building, when done purposefully, fits within the claimable training categories.

Additionally, it is worth noting that team building is an ideal levy-utilisation strategy because:

- It’s fast to implement and can engage multiple departments simultaneously.

- It improves culture, productivity and team dynamics, thereby supporting your business goals.

- It crosses departmental boundaries and is relevant to all levels of staff, making it a smart way to turn unused levy funds into real training investment.

Learn more here: HRDF Claimable Training & Courses: Guidelines & Procedures

How to Plan Your HRD Corp Levy Utilisation for the Rest of 2025–2026?

Step 1 — Build an Annual Training Calendar (Q1–Q4)

Start by mapping out your training roadmap from January through December. Include key trainings, soft skills workshops, leadership development and corporate team building activities. A clear schedule ensures you don’t leave your HRD Corp levy to the last minute.

Step 2 — Mix Soft Skills + Team Building + Leadership Workshops

Create a balanced programme that blends leadership development, soft-skills training and team building. This mix ensures you cover a range of claimable training while engaging teams across departments and levels.

Step 3 — Avoid Last-Minute Q1 Claims

Every year, many companies rush to use their HRD Corp levy at the last minute — and that’s when problems happen. Claims made too close to the deadline risk delays or rejection because of documentation or processing time.

The smarter move? Plan early.

Schedule your team building and training programmes in Q1, so your utilisation is clear, approved, and stress-free when the next levy cycle comes around.

Step 4 — Match HR KPIs: Retention, Engagement, Communication

Link your training schedule to measurable metrics like employee retention rates, engagement scores and inter-department communication. When you align your training spend with these outcomes, your levy becomes a strategic investment, not just a compliance tick-box.

How Strategic Team Building Delivers Real ROI (Not Just “Fun Activities”)?

Modern corporate team building activities aren’t about fluff—they’re a serious investment in business performance. Here’s how they deliver real returns:

- Managers report 70% of the variance in employee engagement, underscoring their influence in building collaborative teams. (Source: Gallup)

- Key metrics improved by strategic team building include reduced turnover and improved employee retention. (Source: Peak Sales)

- Effective teamwork also resulted in faster delivery and improved innovation (Source: Mural)

To make it strategic,

- Set clear learning outcomes: e.g., improved cross-department collaboration, faster decision-making.

- Measure before and after: gather baseline data, use surveys, and project metrics.

- Connect to business goals, not just morale: when you tie team building to leadership, productivity or retention, you shift it from “fun day” to “smart investment.”

- Reinforce the learning: follow-up, refreshers and connect the experience back to daily work.

In short, when you design team-building events with purpose, measurement and follow-through, they become tools for a stronger culture, better performance and measurable business impact.

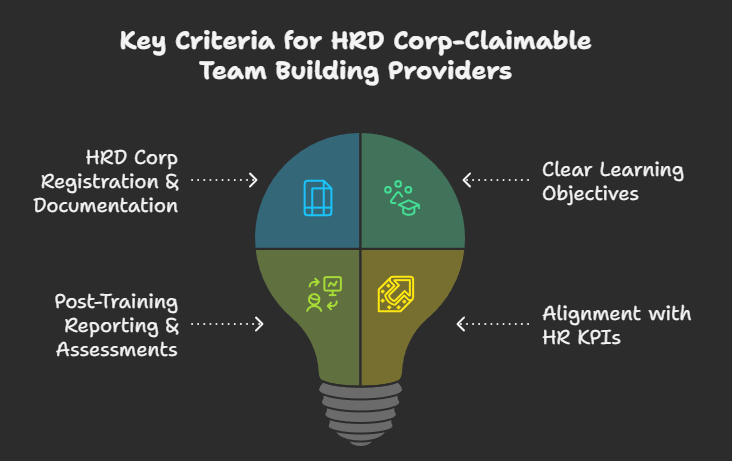

What HR Should Look for in a Claimable Team Building Provider?

Choosing the right partner for your team-building programme is key, especially when it needs to be HRD Corp-claimable. Here are the critical criteria:

HRD Corp Registration & Documentation

- Provider is registered with HRD Corp and offers claimable courses aligned with levy policies.

- Comprehensive documentation: trainer profiles, session outlines, attendance records, invoices—so your finance team can submit claims without hiccups.

Clear Learning Objectives (Not Just Games)

- Activities must have defined outcomes (e.g., improved collaboration, enhanced emotional intelligence, cross-team communication).

- Avoid providers who deliver generic “fun games” without measurable learning or business relevance.

Post-Training Reporting & Assessments

- Depending on the scope of the programme, providers can include post-session assessments, participant feedback, and even behavioural tracking to measure learning outcomes.

- These reports make it easier for HR teams to connect training results with KPIs like engagement, performance, or retention.

Alignment with HR KPIs

- The programme pitches directly to your HR goals—whether it’s boosting workforce engagement, reducing turnover, strengthening teamwork, or enhancing leadership skills.

- Look for evidence of previous clients where the provider delivered outcomes linked to business metrics.

With Thriving Talents, you get a provider that is HRD-claimable, documented and results-driven—designed not just for one-day fun, but for measurable culture and performance impact.

Final Takeaway — Don’t Let Another Year of Levy Go to Waste

Every year, countless Malaysian companies lose thousands in unutilised HRD Corp levy funds—and the cycle repeats.

Even though the Program Latihan MADANI (PLM) deduction for 2024 only applies once, the underlying issue remains: many employers wait until the last minute to plan, and end up losing funds that could have built stronger teams.

The reality is simple: your levy isn’t a tax—it’s a training budget waiting to be maximised.

Strategic team building corporate training is one of the most practical, fast-to-implement ways to utilise your levy while boosting employee engagement, collaboration, and retention.

Instead of scrambling before deadlines, plan ahead and invest in meaningful, HRD Corp-claimable team-building programmes that truly strengthen your culture.

If you want to maximise your levy and strengthen your culture with HRD Corp-claimable team building, Thriving Talents can help. Book a free consultation here.